In Kenya’s retail scene, invoicing is often a slow, repetitive, and error-prone task. Retailers spend hours manually creating, sending, and tracking invoices, which can delay payments and reduce efficiency. Automated invoicing solves these challenges by generating invoices instantly, sending them to customers, and updating financial records automatically.

This system eliminates human errors, speeds up billing, and helps retailers focus on growing their business rather than administrative work. For small kiosks, mid-sized shops, and large supermarkets, automated invoicing can drastically improve operational efficiency.

Why It Matters for Kenyan Retailers

Manual invoicing can lead to mistakes like incorrect pricing or missing details, which frustrate customers and slow revenue collection. Automated invoicing ensures invoices are accurate, consistent, and delivered promptly. It also helps with recurring billing, discounts, tax compliance, and financial reporting, which is especially important in Kenya’s regulated business environment.

By using automation, retailers can save hours of administrative work, reduce late payments, and maintain a professional appearance in front of customers. It also strengthens trust, as accurate invoices reflect reliability and transparency.

How Automated Invoicing Works

Automated systems integrate with point-of-sale, inventory, and accounting platforms. When a sale occurs, an invoice is instantly generated and sent via email, SMS, or WhatsApp. Advanced systems track overdue payments and send reminders automatically. Cloud-based solutions allow business owners to access invoices and financial records from anywhere.

Analytics dashboards can provide insights on payment trends, customer behavior, and revenue forecasts, helping retailers make data-driven decisions for inventory management and promotions.

Use Cases in Kenya

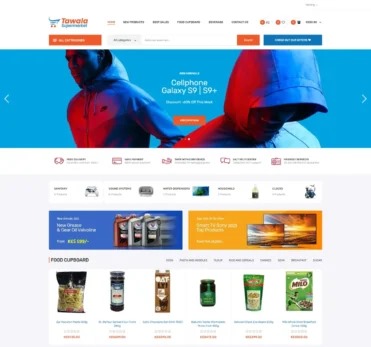

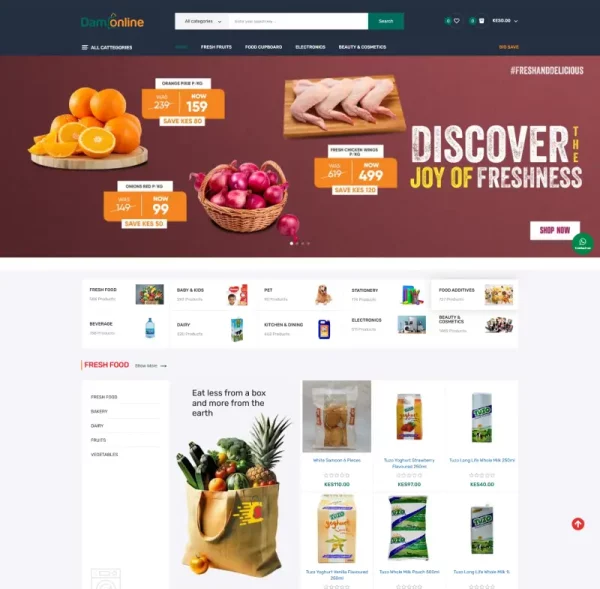

Small shops can instantly generate invoices for daily sales, reducing manual workload. Supermarkets and multi-branch retailers can centralize invoicing, ensuring consistency and better financial control. E-commerce stores benefit the most, handling hundreds of transactions daily while integrating payments like M Pesa or Airtel Money.

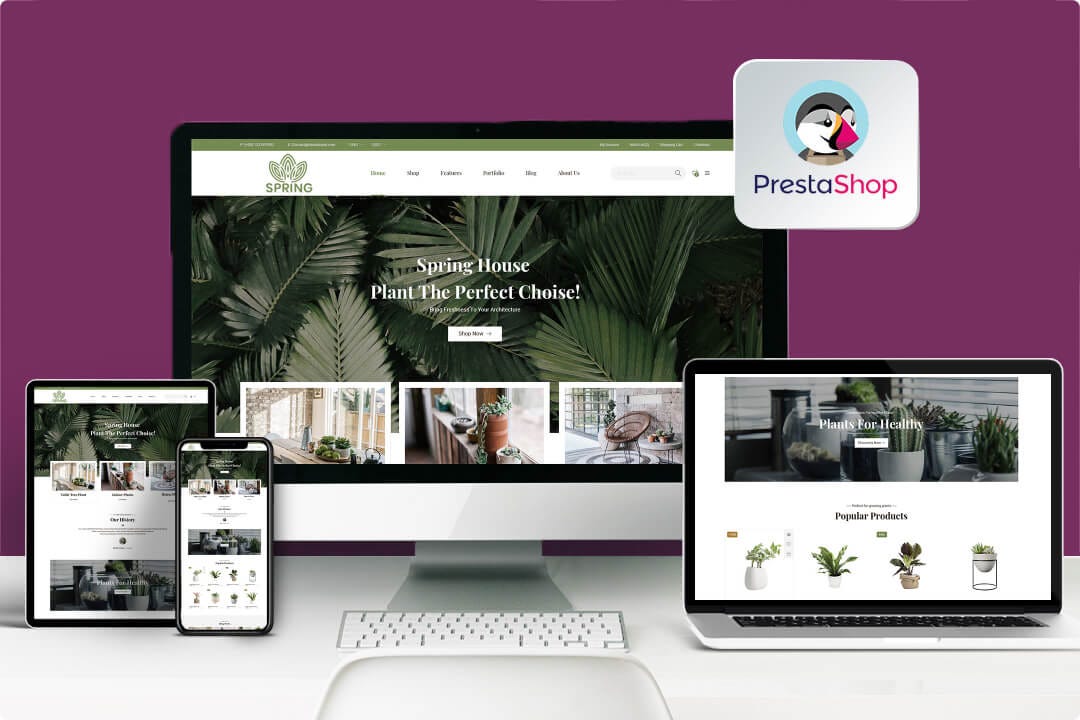

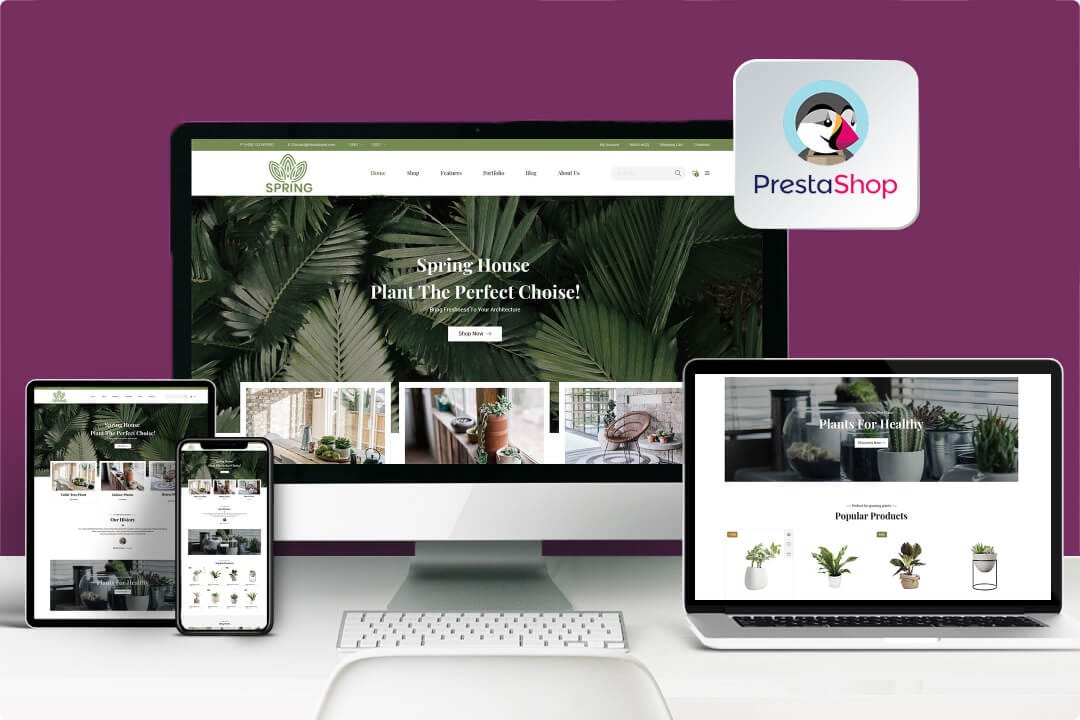

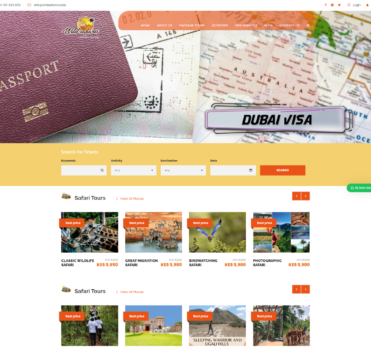

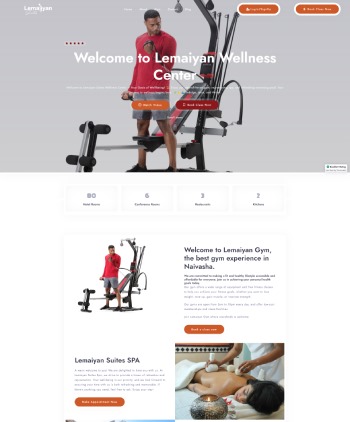

Why Partner with E-Startups Kenya

E-Startups Kenya provides tailored automated invoicing solutions for retail businesses across Kenya and Africa. Our platforms integrate with POS systems, inventory management, and payment gateways, allowing retailers to generate, send, and track invoices automatically. We also provide cloud-based dashboards, analytics, and reporting tools to monitor cash flow and sales trends.

Partnering with us ensures your invoicing process is efficient, accurate, and aligned with local business practices, giving you more time to focus on growth and customer satisfaction.

FAQs

What is automated invoicing?

A system that generates, sends, and tracks invoices automatically, reducing errors and saving time.

Is it suitable for small businesses in Kenya?

Yes, even small kiosks or boutiques can save hours weekly and improve cash flow.

Can it integrate with M Pesa?

Absolutely. Payments through M Pesa, Airtel Money, or banks can be handled seamlessly.

Does it help with tax compliance?

Yes, automated invoicing keeps accurate records ready for VAT reporting and audits.

Is it expensive?

Costs vary, but time saved and reduced errors often outweigh the investment.

Conclusion and Call to Action

Automated invoicing is essential for modern retail in Kenya. It saves time, reduces errors, improves cash flow, and allows retailers to focus on growth and customer service.

Partner with E-Startups Kenya to implement automated invoicing that integrates with your retail systems and payment methods. Transform your invoicing process today and make your business more efficient, professional, and competitive.