For retailers in Kenya, managing sales and finances can quickly become complicated. With multiple branches, online and offline sales channels, and digital payments through M-Pesa, Airtel Money, or cards, keeping accounts accurate is challenging. Manual entry often leads to errors, delayed reports, and lost insights. The solution is clear: integrate accounting software with retail sales systems.

This integration ensures that every transaction, whether in-store or online, automatically updates your accounting records. Businesses gain real-time visibility into sales, expenses, and cash flow, freeing managers to focus on growth rather than reconciliation.

Why Integration Matters for Kenyan Retailers

Many retailers still operate in silos — their POS systems record sales, while accounting software is updated manually at the end of the day. This creates delays, mistakes, and inefficiencies. In a market where margins can be tight, these errors directly affect profitability.

Integration solves this by connecting your sales channels with your accounting platform. Each transaction updates inventory, records revenue, and tracks taxes automatically. For Kenyan businesses using M-Pesa, Airtel Money, or card payments, the system ensures accurate reconciliation without manual input.

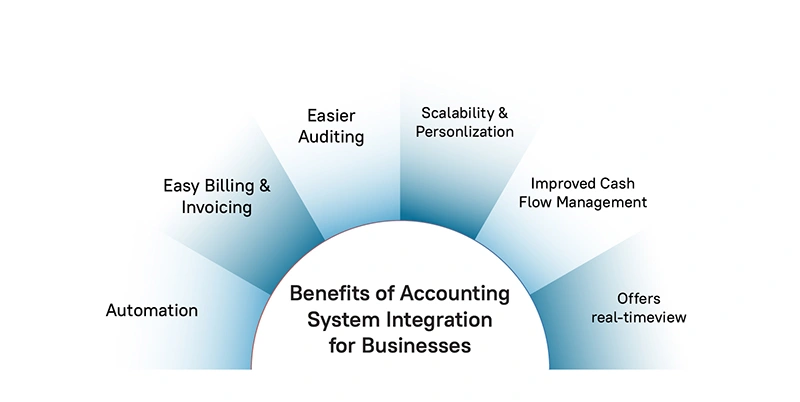

Key Benefits of Integration

Integrated retail and accounting systems offer several advantages:

1. Real-Time Financial Insights

Every sale, return, or discount is reflected immediately in your accounting software. This allows for accurate profit tracking, better budgeting, and smarter business decisions.

2. Reduced Errors and Manual Work

Manual entry is prone to mistakes. Automatic synchronization eliminates human error and reduces staff workload.

3. Faster Tax Compliance

With accurate and up-to-date records, calculating VAT, sales tax, or income tax becomes easier. Retailers in Kenya can generate reports for the Kenya Revenue Authority efficiently.

4. Improved Inventory Management

Integrated systems update stock automatically whenever a sale occurs. You avoid overstocking, understocking, or discrepancies between what is sold and what is recorded.

5. Enhanced Customer Experience

Quick, accurate billing and transparent reporting improve customer trust and loyalty. Errors in pricing or receipts become a thing of the past.

How to Integrate Accounting Software With Retail Systems

Integration can be approached in several ways depending on your business size, POS system, and accounting software.

1. Choose Compatible Software

Ensure your POS system supports integration with popular accounting tools like QuickBooks, Xero, or Sage. Cloud-based POS solutions often have built-in APIs that allow smooth connections.

2. Use APIs and Middleware

APIs (Application Programming Interfaces) act as bridges between your sales and accounting platforms. Middleware solutions can further automate data transfer, ensuring transactions flow seamlessly.

3. Automate Payment Reconciliation

For payments made via M-Pesa, Airtel Money, or card terminals, configure the system to automatically match transactions with invoices in your accounting software. This reduces the need for manual checking and speeds up reconciliation.

4. Test Data Flow

Before full deployment, test the integration with sample sales and returns to ensure data flows correctly, accounts balance, and reports generate accurately.

5. Train Staff

Even with automation, staff should understand how the system works, how to troubleshoot minor issues, and how to access financial reports. Proper training ensures adoption and maximizes efficiency.

Real-World Application

A supermarket in Nairobi integrated its POS system with Xero accounting software. Previously, staff manually recorded daily sales, causing frequent errors and delays. After integration, each M-Pesa and card payment automatically updated the ledger, inventory adjusted in real time, and management could generate profit and loss reports at any moment. This reduced accounting errors by 90 percent and improved cash flow visibility significantly.

The Role of E-Startups Kenya

At E-Startups Kenya, we help retailers integrate their accounting systems with sales platforms smoothly and securely. Our solutions are tailored for Kenyan businesses and include:

• POS integration with QuickBooks, Xero, and Sage

• M-Pesa and Airtel Money payment reconciliation

• Real-time inventory and sales tracking

• Custom reporting dashboards

• Cloud hosting and data security

By combining expertise in retail technology and accounting automation, we ensure seamless operations that save time, reduce errors, and improve profitability.

FAQs

Can small retail shops in Kenya benefit from this integration?

Yes. Even small stores can automate accounting tasks, reduce errors, and save time.

Is it possible to integrate multiple POS systems with one accounting software?

Absolutely. Cloud-based accounting software can aggregate data from multiple sales points.

Does integration support mobile and online payments?

Yes. Payments through M-Pesa, Airtel Money, and cards are automatically reconciled.

Do I need technical expertise to implement integration?

With a partner like E-Startups Kenya, no. We handle setup, training, and ongoing support.

Will integration improve tax compliance?

Yes. Automated, accurate records make VAT, sales tax, and income tax reporting faster and more reliable.

Conclusion

Integrating accounting software with retail sales systems is no longer a luxury for Kenyan retailers — it’s essential. Automation reduces errors, saves time, enhances inventory control, and provides actionable financial insights.

With E-Startups Kenya, businesses can implement seamless integrations that work across all sales channels and payment methods, empowering retailers to focus on growth and customer satisfaction instead of manual bookkeeping.