Kenya’s retail landscape is transforming faster than ever. Digital payments that were once limited to M-Pesa and card swipes have evolved into smarter, faster, and more customer-centered solutions. Among the most disruptive trends are QR payments and Buy Now Pay Later (BNPL) systems. These technologies are redefining how Kenyans shop, spend, and manage their finances — and how retailers handle sales and loyalty.

For forward-thinking business owners, understanding and embracing these innovations isn’t optional anymore. It’s the key to staying competitive in a digital-first market.

The Evolution Of Digital Payments In Kenya

Kenya has long been a leader in mobile money innovation. M-Pesa’s success laid the foundation for a cashless economy, making digital transactions a part of everyday life. Now, QR payments and BNPL are building upon that legacy by adding flexibility, speed, and smarter financial options for both consumers and retailers.

Consumers want convenient ways to pay without carrying cash or cards. Retailers, on the other hand, want systems that are fast, secure, and integrated with their sales and inventory. QR payments and BNPL deliver exactly that.

What Are QR Payments?

QR (Quick Response) payments allow customers to pay instantly by scanning a code with their phone camera. Instead of entering numbers or waiting for confirmation texts, the process is immediate, seamless, and error-free.

A retailer displays a QR code at checkout, and the customer scans it using their preferred payment app — whether it’s M-Pesa, Airtel Money, or a banking app. The payment is completed in seconds, and both parties receive instant confirmation.

QR codes are easy to set up and work across multiple platforms, which makes them ideal for small businesses, supermarkets, restaurants, and even delivery services.

What Is Buy Now Pay Later (BNPL)?

BNPL allows customers to purchase items immediately and pay for them in installments over time, usually with little or no interest. This model has gained popularity globally, and now it’s taking root in Kenya’s growing digital economy.

BNPL providers partner with retailers to offer flexible payment options at checkout, either online or in-store. Shoppers can buy what they need — from electronics to groceries — and pay over weeks or months.

Why BNPL Is Gaining Popularity In Kenya

1. Increased Access To Credit

Traditional credit cards remain out of reach for many Kenyans. BNPL bridges that gap by offering easy, instant access to credit during purchase.

2. Customer Convenience

BNPL appeals to customers who prefer managing payments in smaller portions without heavy upfront costs.

3. Boosted Retail Sales

Retailers who integrate BNPL often see higher conversion rates and bigger basket sizes because customers feel more confident purchasing high-value items.

4. Loyalty And Retention

When customers find flexible payment options at a particular store, they are more likely to return.

5. Integration With Digital Platforms

BNPL services can be embedded into websites, mobile apps, and POS systems, allowing businesses to offer flexible financing without complex paperwork.

The Impact On Kenyan Retailers

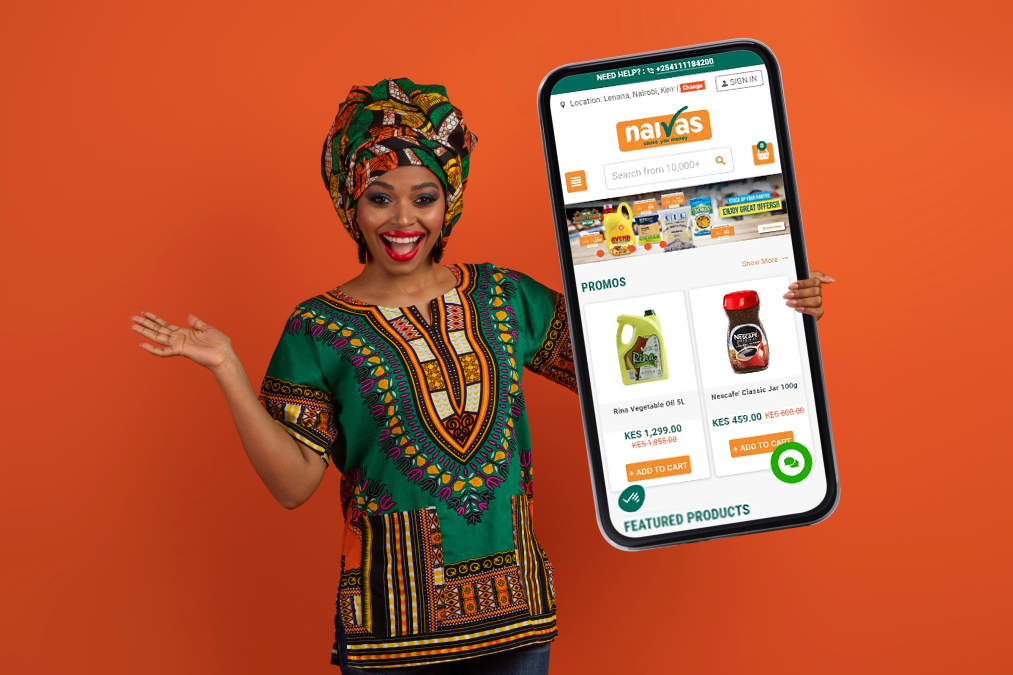

Retailers in Kenya who have adopted QR payments and BNPL are seeing measurable results. Cash handling has reduced, reconciliation is faster, and customer retention has improved. These technologies are also helping businesses tap into younger, tech-savvy consumers who prefer instant mobile interactions over traditional payments.

BNPL is particularly powerful for online and lifestyle retailers. It allows customers to enjoy products immediately without financial strain, increasing customer satisfaction and repeat purchases.

QR payments, meanwhile, are proving vital for everyday retail — from mini supermarkets to restaurants — simplifying transactions and cutting costs.

The Benefits Of QR Payments For Kenyan Retailers

QR payments are transforming transactions across Kenya because they solve key retail challenges:

1. Faster Transactions

Customers no longer queue waiting for change or PIN confirmations. Payments are processed instantly, improving checkout speed and customer satisfaction.

2. Reduced Hardware Costs

Retailers don’t need card machines or complicated setups. A printed or digital QR code is enough to accept payments.

3. Seamless Integration

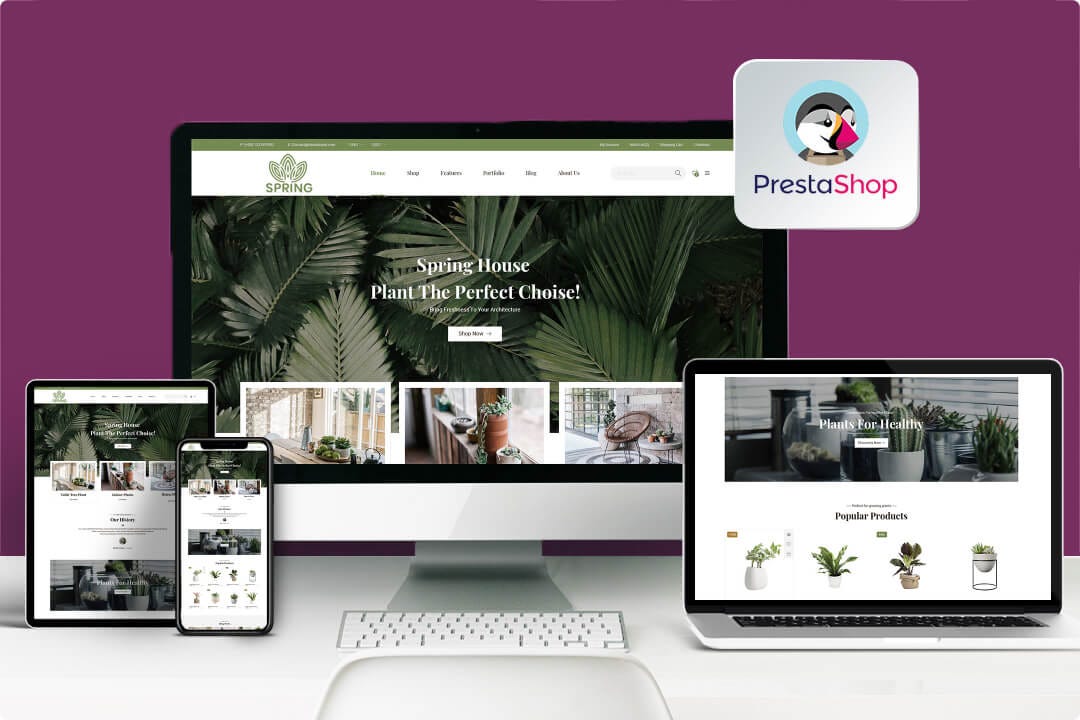

QR systems easily integrate with modern POS and accounting software. At E-Startups Kenya, our POS solutions sync automatically with QR payments for real-time sales tracking.

4. Enhanced Security

Transactions occur directly between the customer and the payment gateway, reducing fraud risk and chargebacks.

5. Better Customer Insights

Digital payments generate data that helps retailers understand customer spending behavior and design personalized promotions.

Challenges To Consider

While QR and BNPL offer major advantages, there are factors that retailers must manage carefully:

• Fraud Prevention: QR codes must be secure and verified to prevent scams.

• Cash Flow Management: With BNPL, retailers receive payments in phases, so proper financial planning is key.

• Customer Education: Some consumers may need guidance on how to use QR codes or understand BNPL terms clearly.

With trusted partners like E-Startups Kenya, these challenges can be minimized. We provide integrated, secure, and customized payment systems that fit your business needs.

How E-Startups Kenya Helps Retailers Adopt QR And BNPL

E-Startups Kenya specializes in helping retailers transition to modern payment ecosystems. We build systems that connect QR payments, BNPL, M-Pesa, Visa, and POS into one smooth experience.

With our solutions, businesses can:

• Accept instant QR payments through multiple providers

• Offer BNPL options integrated with checkout systems

• Track sales, customer behavior, and credit performance in real time

• Access analytics dashboards to understand payment trends

• Enjoy secure cloud hosting with AWS and Cloudflare performance

Our mission is to empower Kenyan retailers to operate smarter, faster, and more profitably in the digital era.

The Future Of Retail Payments In Kenya

QR payments and BNPL are just the beginning of a new financial revolution. As Kenya continues to digitize commerce, retailers who adapt early will dominate the market.

Customers now expect instant, flexible, and transparent payment experiences. Businesses that offer these options will not only retain customers but also build stronger, data-driven operations that can scale across the country.

Conclusion

The retail sector in Kenya is evolving beyond cash and traditional card payments. QR payments and BNPL represent the future of transactions — simple, digital, and customer-centered.

By partnering with E-Startups Kenya, retailers can integrate these modern payment methods seamlessly, improving efficiency, sales, and loyalty.

In a competitive market, speed and convenience win. With QR and BNPL systems in place, your business is not just keeping up — it’s leading.