The Smart Way to Budget for Small Businesses

Running a small business in Kenya can feel like a balancing act — juggling expenses, chasing clients, managing inventory, and still trying to make a profit. With fluctuating markets, high competition, and unpredictable costs, a clear and strategic budget can be the difference between success and struggle.

Budgeting isn’t just about cutting costs; it’s about planning for growth, sustainability, and resilience. Whether you’re running a fashion store in Nairobi, a small tech startup in Mombasa, or a logistics business in Kisumu, smart budgeting ensures you stay in control of your cash flow and future.

Why Budgeting Matters for Small Businesses

Many small businesses in Kenya fail not because they lack customers, but because they mismanage cash flow. Without a clear budget, it’s easy to overspend on non-essentials or underinvest in growth opportunities.

A good budget helps you:

Track every shilling: Knowing where your money goes prevents wastage.

Plan for uncertainty: Emergencies, market shifts, or slow seasons won’t catch you off-guard.

Set clear goals: Budgets align financial decisions with your business strategy.

Attract investors or loans: Lenders and investors trust businesses that demonstrate financial discipline.

In Kenya’s competitive business scene, budgeting isn’t optional — it’s a survival skill.

I. Understand Your Cash Flow

The first step to smart budgeting is knowing how money moves in and out of your business.

Record All Income: List all revenue sources — sales, subscriptions, or services — to know your real income.

Track All Expenses: Include everything from rent, salaries, and stock to utilities and internet bills.

Identify Trends: Check which months bring more income and which have higher expenses.

Tools like QuickBooks, Zoho Books, or Google Sheets can help you automate tracking and generate reports.

II. Separate Business and Personal Finances

This is one mistake many Kenyan entrepreneurs make — mixing personal and business funds. When the two blend, it becomes hard to know if your business is truly profitable.

Open a Business Bank Account: Keep all transactions business-related.

Pay Yourself a Salary: Treat your income like an employee’s — consistent and separate from profits.

Use Accounting Software: This helps track and categorize all spending automatically.

E-Startups Kenya helps businesses integrate digital accounting tools and mobile money APIs like M-Pesa and Airtel Money to simplify financial management.

III. Prioritize Essential Expenses

A smart budget focuses first on what keeps your business running. Label your expenses in three categories:

I. Essential Costs: Rent, utilities, staff wages, licenses, and internet — things you can’t operate without.

II. Growth Investments: Marketing, product development, and digital tools that bring long-term returns.

III. Non-Essentials: Luxury items or things that don’t directly impact your bottom line.

This structure helps you cut unnecessary costs while ensuring you still invest in growth.

IV. Build an Emergency Fund

Every small business faces unexpected costs — a broken laptop, delayed payment, or sudden market dip. Having an emergency fund keeps operations running smoothly during tough times.

Start Small: Set aside 5–10% of your monthly revenue.

Automate Savings: Use mobile banking to automatically transfer funds into a reserve account.

Keep It Accessible: Your emergency fund should be easy to withdraw during real crises.

Financial discipline is what separates struggling businesses from sustainable ones.

V. Plan for Growth, Not Just Survival

Budgeting isn’t only about saving — it’s also about growing strategically. Allocate part of your funds toward expanding your reach, upgrading tools, or training your staff.

Invest in Marketing: Digital marketing — especially on platforms like TikTok, Instagram, and Google — helps attract more customers.

Upgrade Operations: Tools like CRM systems, cloud accounting, and automation improve efficiency.

Train Your Team: A well-trained team delivers better results and increases business value.

E-Startups Kenya provides digital growth strategies and AI-driven analytics to help you make smarter investment decisions.

VI. Review and Adjust Regularly

A budget isn’t a one-time thing — it’s a living document. Review it monthly or quarterly to ensure it still fits your goals.

Compare Projected vs. Actual Spending: Identify leaks or overspending early.

Adjust Based on Growth: As your income increases, reallocate funds toward expansion.

Use Data Insights: Rely on analytics to make data-driven financial decisions instead of guesswork.

Successful businesses evolve, and so should their budgets.

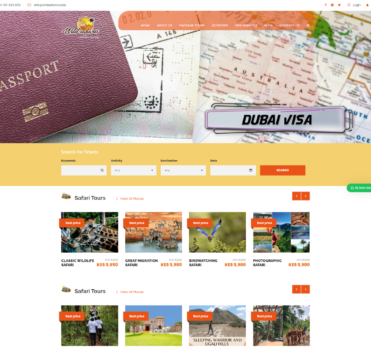

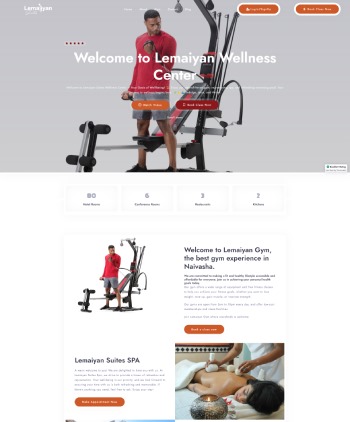

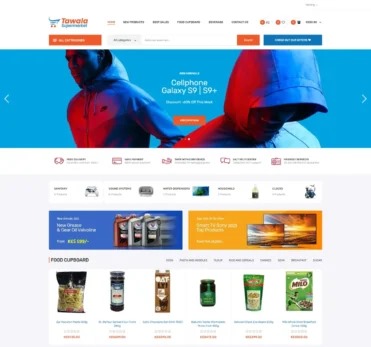

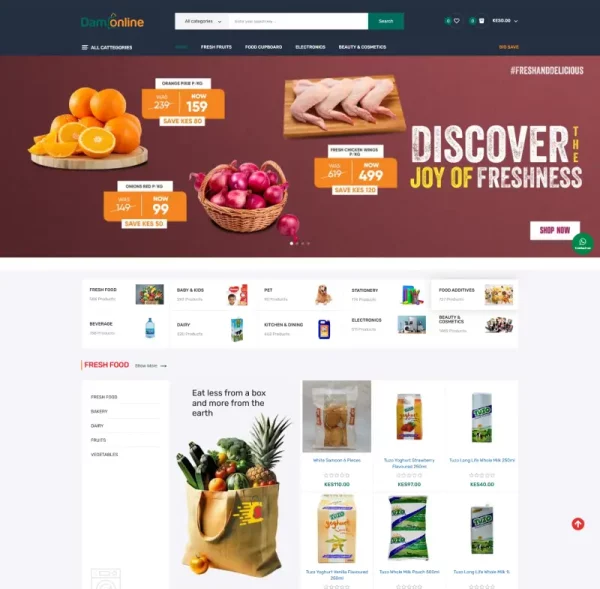

VII. How E-Startups Kenya Supports Smart Financial Management

At E-Startups Kenya, we help small businesses modernize their financial management through smart digital systems. Our solutions include:

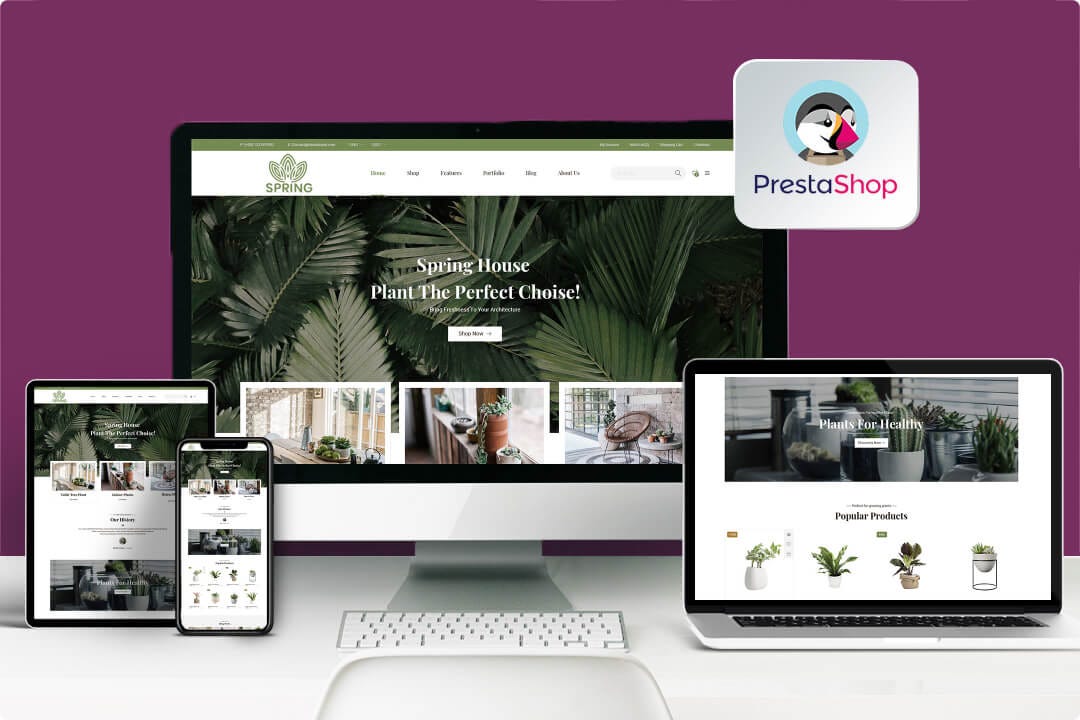

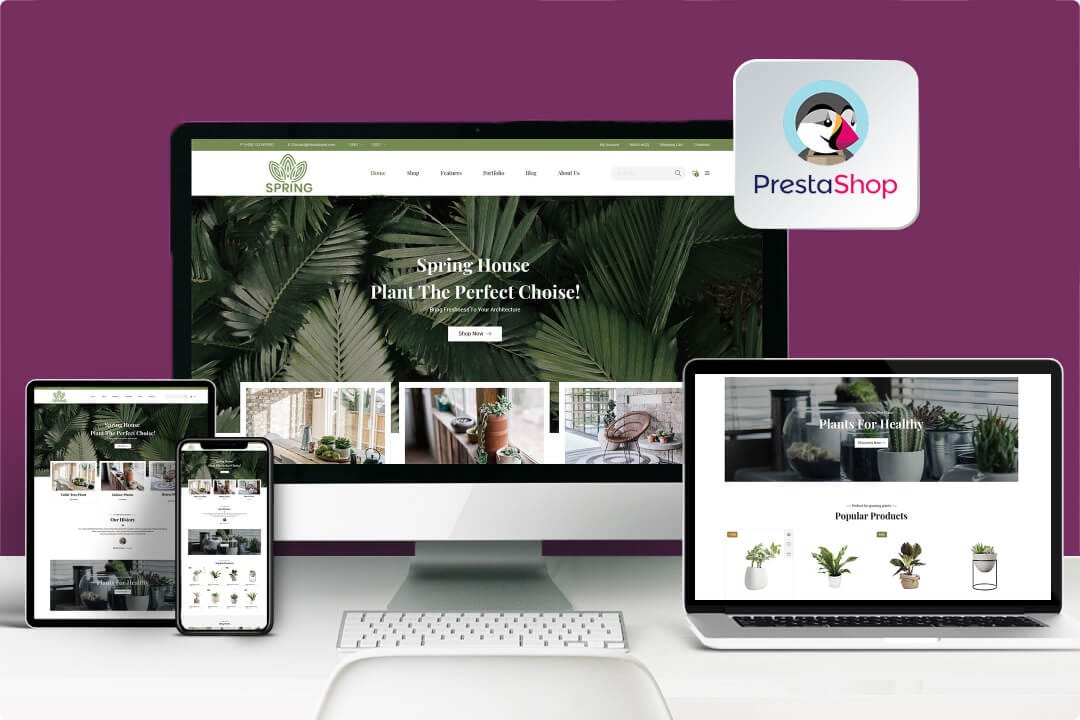

Cloud Accounting Integration: Manage finances securely with tools like QuickBooks and Zoho.

E-Commerce Systems with Payment Integration: Accept M-Pesa, Airtel Money, and card payments seamlessly.

AI & Automation Tools: Track expenses, forecast trends, and detect financial risks automatically.

Custom Business Dashboards: Get real-time visibility into your company’s performance.

We empower entrepreneurs to make informed, data-backed decisions — not guesses.

FAQs

1. How can a small business in Kenya start budgeting effectively?

Begin by tracking all income and expenses, separating personal and business finances, and setting realistic goals.

2. Should I hire an accountant or use software?

Small businesses can start with digital tools like QuickBooks or Zoho. As you grow, combining software with a professional accountant offers the best results.

3. How much should I save for emergencies?

Ideally, save at least three months of operational expenses. Even starting small builds financial resilience over time.

4. Can budgeting help me attract investors?

Yes. Investors and lenders look for businesses with clear financial plans and transparent cash flow reports.

5. How can E-Startups Kenya help me manage my business finances?

We offer digital accounting, payment integration, and AI-powered analytics to help you streamline your financial operations.

Conclusion

Smart budgeting is about control, clarity, and consistency. It gives your business a clear financial roadmap and protects it from sudden shocks. For Kenyan entrepreneurs looking to scale sustainably, the right budgeting strategy can unlock both stability and growth.

Ready to take control of your business finances?

Partner with E-Startups Kenya today and let’s design smart financial systems that help your business grow with confidence and clarity.