Introduction

Kenya is one of Africa’s fastest-growing digital economies. From mobile money to e-commerce, digital platforms are fueling growth for businesses of all sizes. Yet with opportunity comes risk. Cyberattacks, data breaches, and online fraud are rising sharply, and startups are often the most vulnerable targets.

Many entrepreneurs believe cybercriminals only target big corporations, but the truth is different. Hackers often prefer small and medium-sized businesses because they assume security is weak. For Kenyan startups, ignoring cybersecurity can mean financial loss, reputational damage, and even closure.

This article explores why cybersecurity is a non-negotiable for startups in Kenya, the key risks they face, and how E-Startups Kenya provides solutions to keep businesses safe.

Why Cybersecurity Matters for Kenyan Startups

I. The Rise of Digital Business

Kenya leads in mobile money penetration, with M-Pesa processing billions of shillings daily. E-commerce platforms, fintech apps, and cloud systems are now common. This growth also increases exposure to digital crime.

II. Cost of Cybercrime

According to the Communications Authority of Kenya, the country recorded over 300 million cyber threat incidents in just the first half of 2023. For a startup with limited resources, even one attack can wipe out operations.

III. Customer Trust and Data Protection

Customers expect businesses to keep their information safe. With Kenya’s Data Protection Act in place, startups must comply with regulations or risk fines and reputational damage.

IV. Investor Confidence

Investors are more likely to fund startups that have secure systems. Strong cybersecurity shows that the business is professional, responsible, and future-ready.

Common Cybersecurity Threats Facing Kenyan Businesses

Phishing Attacks

Hackers send fake emails or messages pretending to be trusted organizations, tricking staff into giving away passwords or bank details.Ransomware

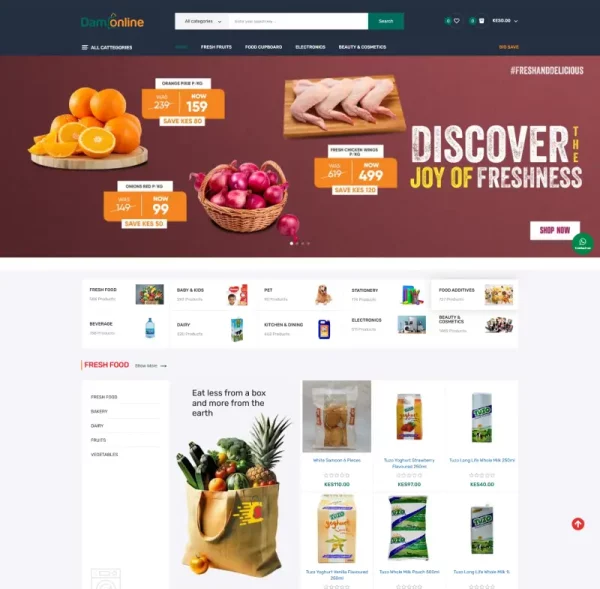

Cybercriminals lock business systems and demand payment before restoring access. This is devastating for startups that rely heavily on daily digital operations.Mobile Money Fraud

With Kenya’s heavy reliance on M-Pesa and Airtel Money, fraudsters often target digital payment platforms. Weak integration exposes businesses to transaction manipulation.Data Breaches

Poorly secured databases can be hacked, leaking sensitive customer data like phone numbers, IDs, and bank details.Insider Threats

Sometimes employees misuse access or accidentally expose systems to risks. Startups without policies are especially vulnerable.Weak Passwords and Lack of Updates

Simple mistakes like using weak passwords or failing to update software open the door to hackers.

How Startups Can Protect Themselves

I. Employee Awareness Training

Human error is often the biggest risk. Training staff to recognize phishing attempts and practice safe digital habits is essential.

II. Strong Authentication Systems

Using two-factor authentication, biometrics, or token verification makes it harder for attackers to access systems.

III. Regular System Updates

Startups must keep their apps, websites, and software updated to patch security loopholes.

IV. Cloud Security

For businesses using cloud services, encryption and secure backup systems are key to protecting data.

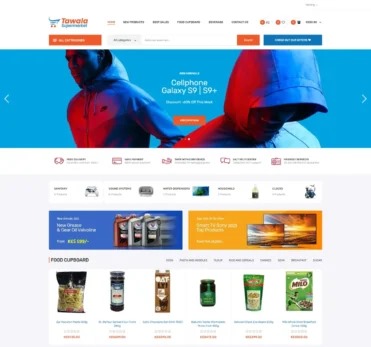

V. Secure Payment Integrations

M-Pesa and Airtel Money integrations should include fraud detection and transaction monitoring to protect both businesses and customers.

VI. Cybersecurity Policies

Even small businesses should have basic rules for password management, device use, and data storage.

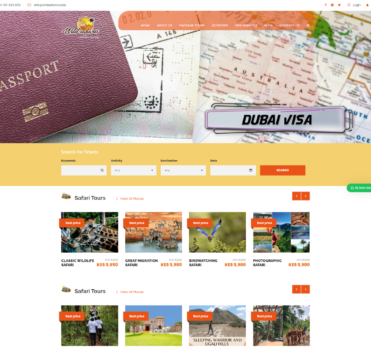

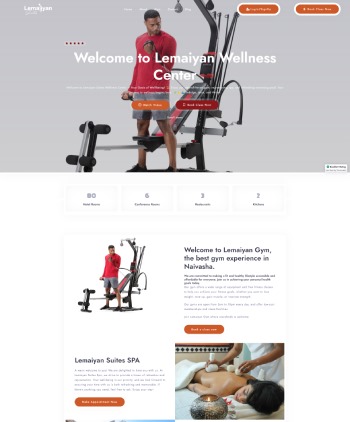

Business Use Cases in Kenya

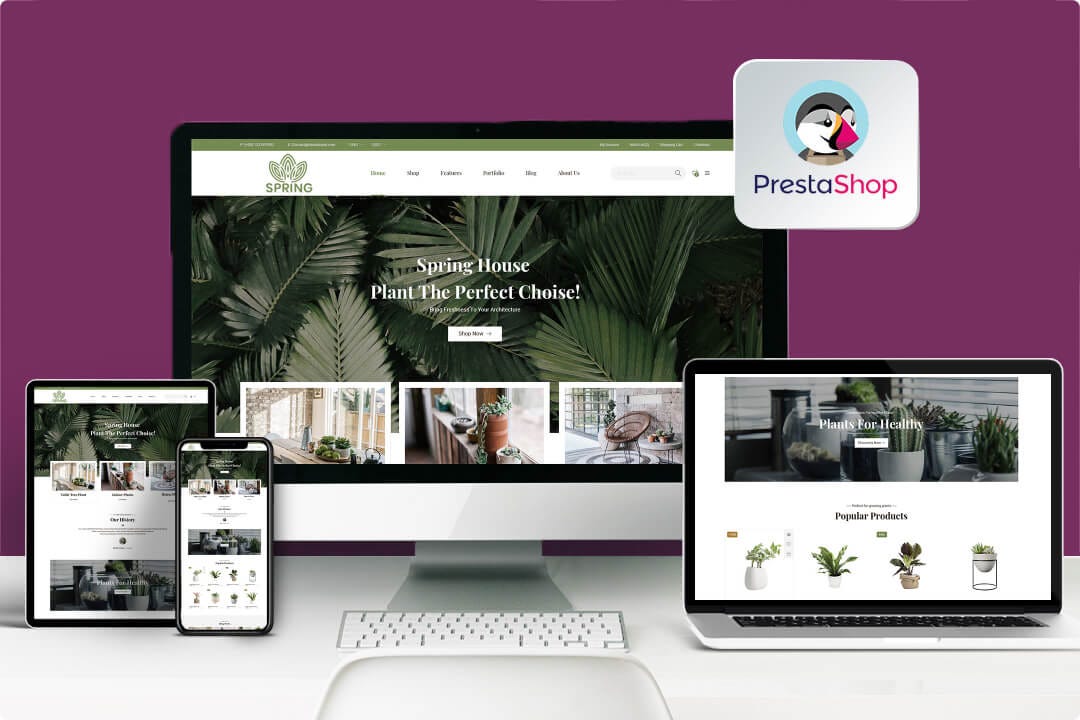

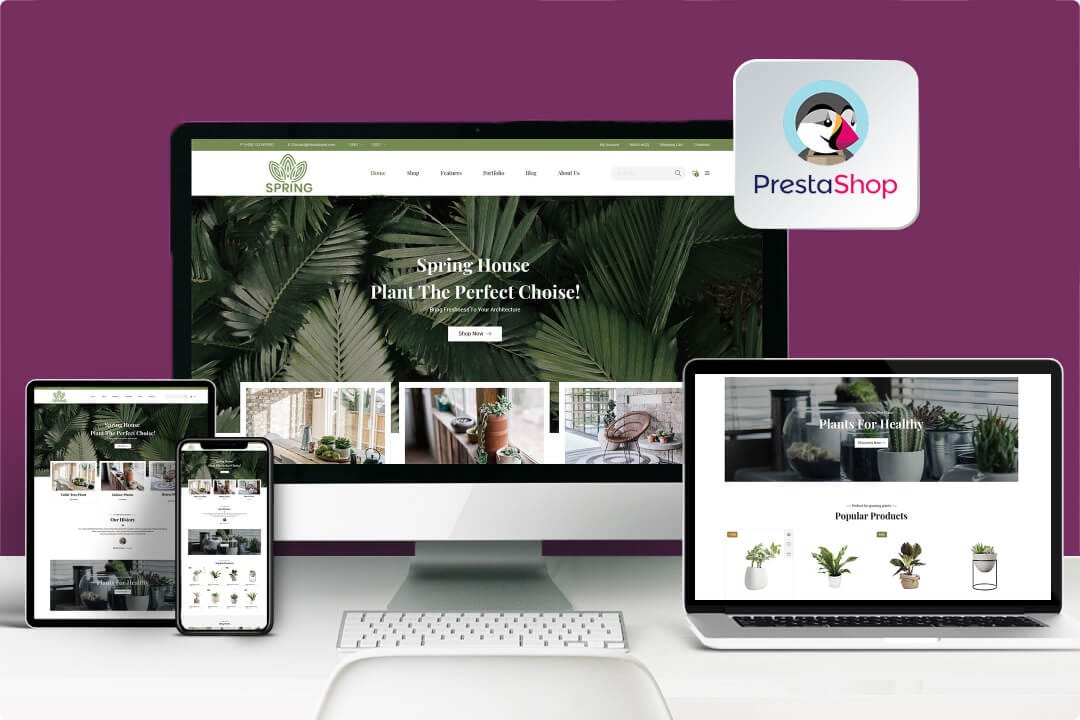

I. E-Commerce Stores

An online shop loses credibility immediately if customer payment details are leaked. Secure platforms ensure safe transactions and trust.

II. FinTech Startups

Digital lending and mobile money platforms are high-value targets. Strong cybersecurity keeps customer data safe and builds investor confidence.

III. HealthTech Platforms

Patient records must remain private under Kenya’s Data Protection Act. Digital security ensures compliance and trust in the platform.

IV. AgriTech Apps

Farmers using mobile platforms for payments or supply chain tracking need assurance that their data and money are safe.

Why Partner with E-Startups Kenya

E-Startups Kenya provides end-to-end cybersecurity solutions for startups and businesses of all sizes. Our services include:

Penetration testing to identify vulnerabilities before hackers exploit them.

Cloud security systems with data encryption and backup.

Fraud-resistant payment integrations with M-Pesa and Airtel Money.

Cybersecurity training for employees and teams.

Compliance support to meet Kenya’s Data Protection Act requirements.

Ongoing monitoring and support to ensure businesses stay protected.

By working with E-Startups Kenya, startups gain not only digital protection but also peace of mind, investor confidence, and customer trust.

FAQs

Q1: Why are startups in Kenya at risk of cyberattacks?

Because many startups have limited budgets and weaker security, making them easier targets for hackers.

Q2: How much does a cyberattack cost a small business?

Even a single attack can cost millions in lost revenue, legal fines, and reputational damage. For startups, this can mean closure.

Q3: Is cybersecurity expensive for startups?

Not necessarily. Many affordable solutions like cloud backups, training, and secure payment integrations are cost-effective for SMEs.

Q4: What law governs data protection in Kenya?

The Data Protection Act of 2019 regulates how businesses collect, store, and use customer data.

Q5: How does E-Startups Kenya help with cybersecurity?

We provide tailored digital protection, secure payment systems, cloud security, and compliance solutions for businesses in Kenya and Africa.

Conclusion

Cybersecurity is not a luxury — it is a necessity for startups in Kenya. With the rise of digital business models, mobile payments, and online platforms, the risks are higher than ever. By ignoring cybersecurity, startups put themselves at risk of financial loss, reputational damage, and even legal trouble.

At E-Startups Kenya, we believe technology should empower businesses, not endanger them. That’s why we design solutions that protect startups from cyber threats and ensure long-term growth.

👉 Ready to secure your startup? Contact E-Startups Kenya today for tailored cybersecurity solutions that safeguard your future.