Introduction

In Kenya, online transactions have become part of everyday life. From ordering food through apps to buying clothes on Instagram shops or sending money via M-Pesa, more people are choosing digital transactions over physical cash. This shift has opened new opportunities for businesses, but it has also raised one major challenge: trust.

Many customers remain skeptical about paying online because they fear fraud, delayed deliveries, or poor service. For a business that wants to thrive in the digital economy, building trust is no longer a luxury — it is a survival strategy. Without trust, even the best online product or service will struggle to attract repeat customers.

So, how can Kenyan businesses overcome this barrier and convince customers that online transactions are safe, reliable, and worth their money?

Why Trust is a Big Issue in Online Transactions

There are several reasons why Kenyan customers hesitate when it comes to paying online. Some of these are historical while others are rooted in current experiences.

I. Fraud and scams

The rise of online shopping has also created room for fake sellers and fraudsters. Stories of people paying for goods that never arrived have made customers cautious.

II. Poor customer service

When businesses fail to answer calls, delay deliveries, or ignore complaints, they reinforce the belief that online transactions are unreliable.

III. Lack of transparency

Some businesses hide important details like return policies, delivery timelines, or full product descriptions. This makes customers feel they are taking unnecessary risks.

IV. Inconsistent systems

If a payment link fails, if the website is slow, or if a mobile checkout process crashes midway, the customer loses confidence immediately.

These challenges show why Kenyan businesses must actively invest in building trust. The good news is that technology provides tools and strategies that can bridge this gap.

Practical Ways to Build Customer Trust in Online Transactions

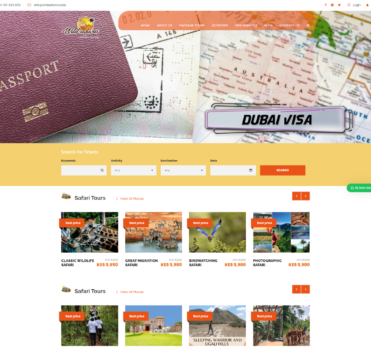

I. Secure and reliable payment systems

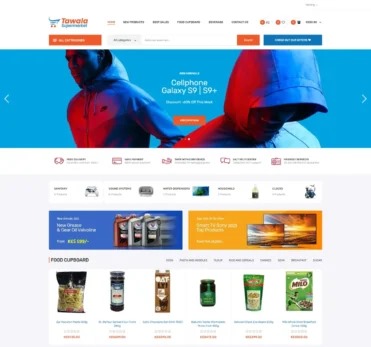

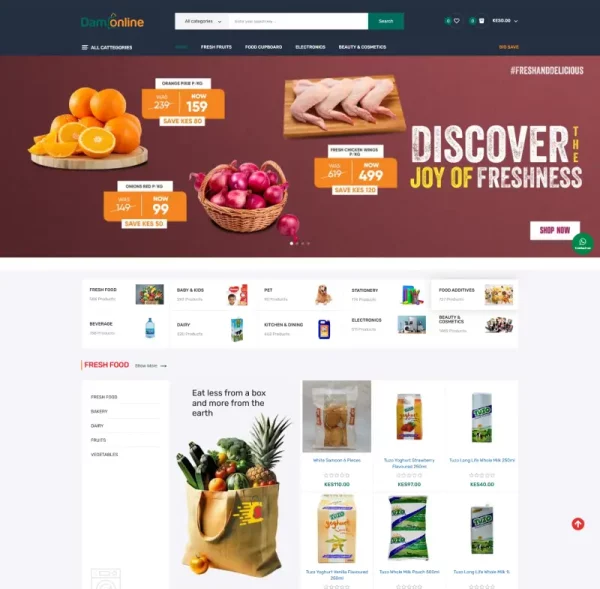

Customers need to know that their money is safe. Businesses should integrate trusted payment options such as M-Pesa, Airtel Money, or verified card systems. Security seals like SSL certificates on websites assure customers that their data is protected.

II. Transparency in pricing and policies

Nothing frustrates a customer more than hidden costs. Being upfront about pricing, delivery charges, and refund policies creates confidence. For instance, if a delivery fee applies, state it clearly rather than surprising the customer at checkout.

III. Consistent communication

When a customer places an order, they should not be left in the dark. Automated SMS or WhatsApp confirmations, real-time delivery updates, and follow-up messages all build trust. Communication signals reliability.

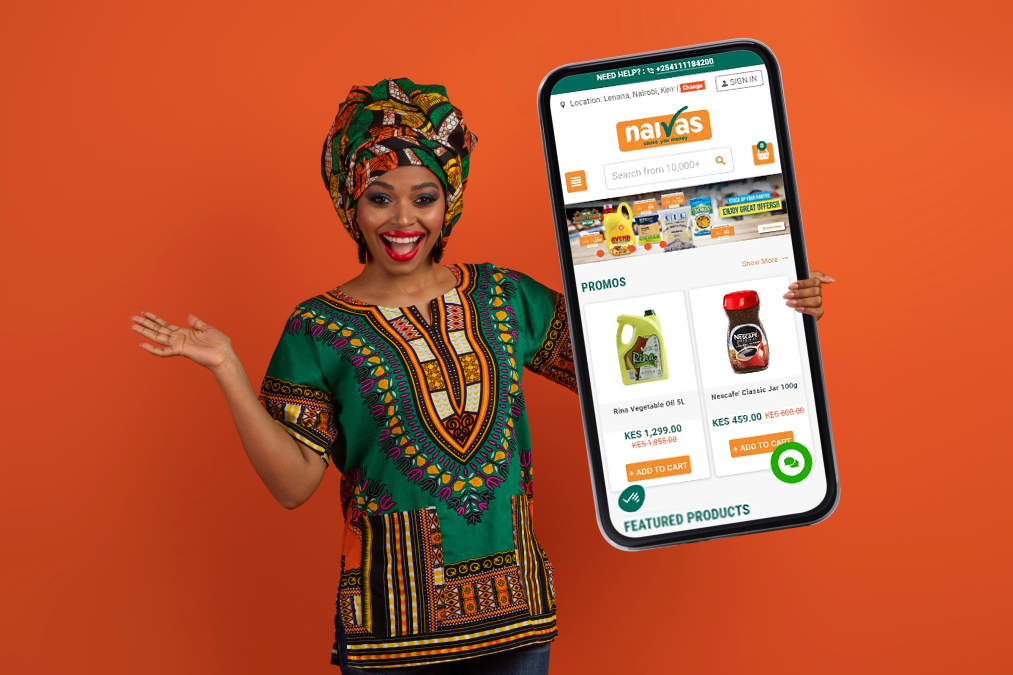

IV. Social proof through reviews and testimonials

Kenyans value word of mouth. Online reviews, customer testimonials, and user-generated content reassure potential buyers that others have had positive experiences. A new customer is more likely to trust a business if they see five people praising it online.

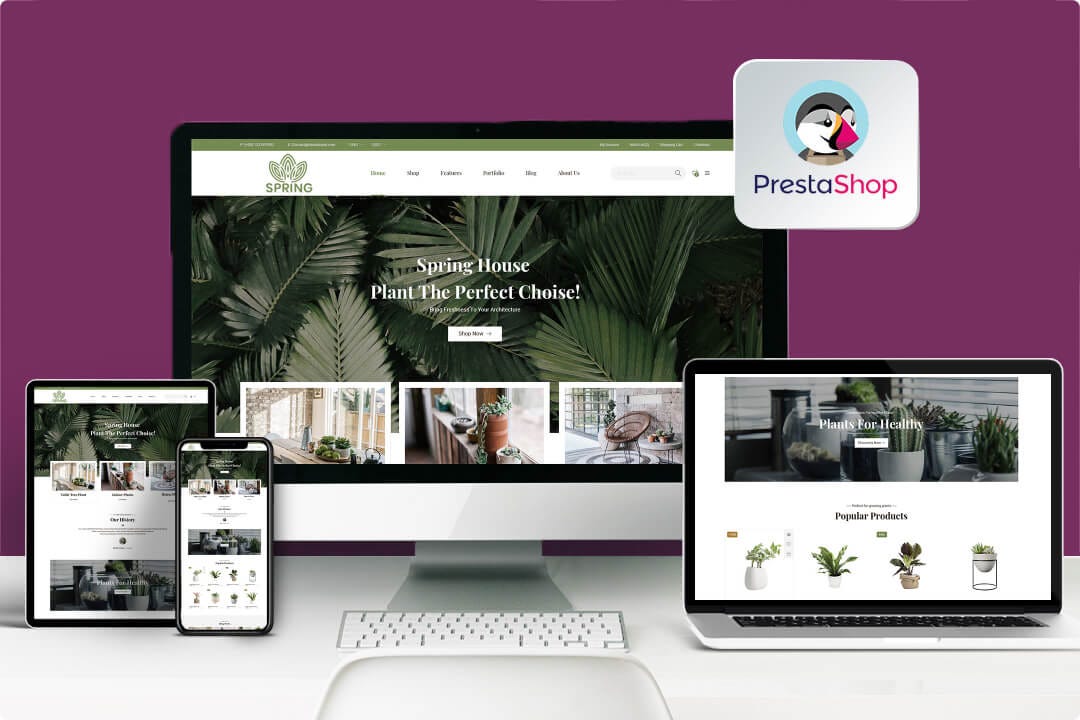

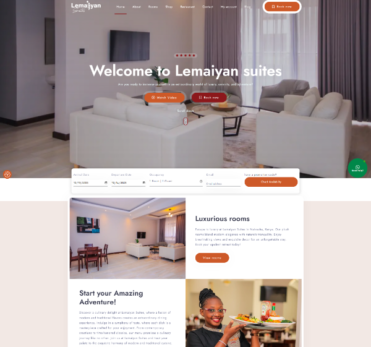

V. Professional online presence

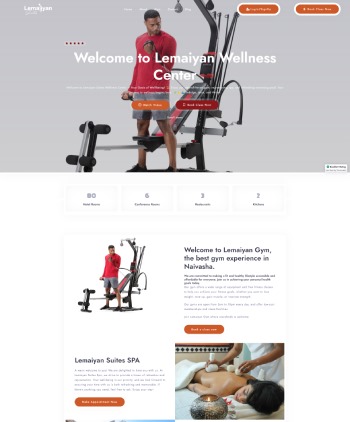

A sloppy website or inactive social media page raises red flags. A clean, mobile-friendly website, active social media engagement, and consistent branding tell customers that the business is legitimate and professional.

VI. Delivery reliability

Customers want what they ordered, delivered on time. Partnering with reliable logistics companies and providing tracking options shows that a business respects its clients. Each successful delivery strengthens trust for future transactions.

VII. Customer support availability

When issues arise, clients should know there is a real person or team they can contact. Having customer service available on WhatsApp, email, or phone creates a safety net that makes customers more comfortable with online payments.

How Businesses in Kenya Can Grow Online by Building Trust

Once trust is established, growth naturally follows. Businesses that master customer confidence can tap into the full potential of the online space.

They attract repeat customers. Trust turns one-time buyers into loyal clients who keep coming back.

They gain referrals. Satisfied customers tell their friends and family, creating organic growth.

They expand beyond borders. With strong systems, a Kenyan business can serve not only local clients but also international ones who are looking for trusted African brands.

They reduce marketing costs. When customers trust a business, less convincing is needed, meaning ad spend can be lower while conversions remain high.

Why Trust is the Backbone of Online Growth in Kenya

Kenya is already leading Africa in mobile money adoption, and the future of commerce is digital. However, unless businesses take deliberate steps to make customers feel safe, the growth of online transactions will be limited. Trust is not built overnight; it comes from consistent delivery, transparency, and a willingness to adapt technology to meet customer needs.

For SMEs and startups, the message is clear. Invest in systems that protect customer data, deliver products reliably, and keep communication open. Do that consistently, and your business will not only stop losing customers but will also gain new ones every single day.

Conclusion

The digital economy in Kenya is growing rapidly, but trust is what separates businesses that succeed from those that fail. Customers will not hesitate to abandon an online business the moment they feel unsafe or disrespected.

Technology offers the tools to bridge this gap: secure payments, reliable communication, professional online presence, and consistent delivery. By focusing on these areas, Kenyan businesses can turn skepticism into confidence and one-time buyers into long-term partners.

At E-Startups Kenya, we believe building trust is the foundation for growth. We provide solutions that help businesses secure their transactions, improve communication, and deliver consistently so that customers feel safe and valued.

👉 If you are ready to grow online by building trust with your clients, let us help you take the next step.