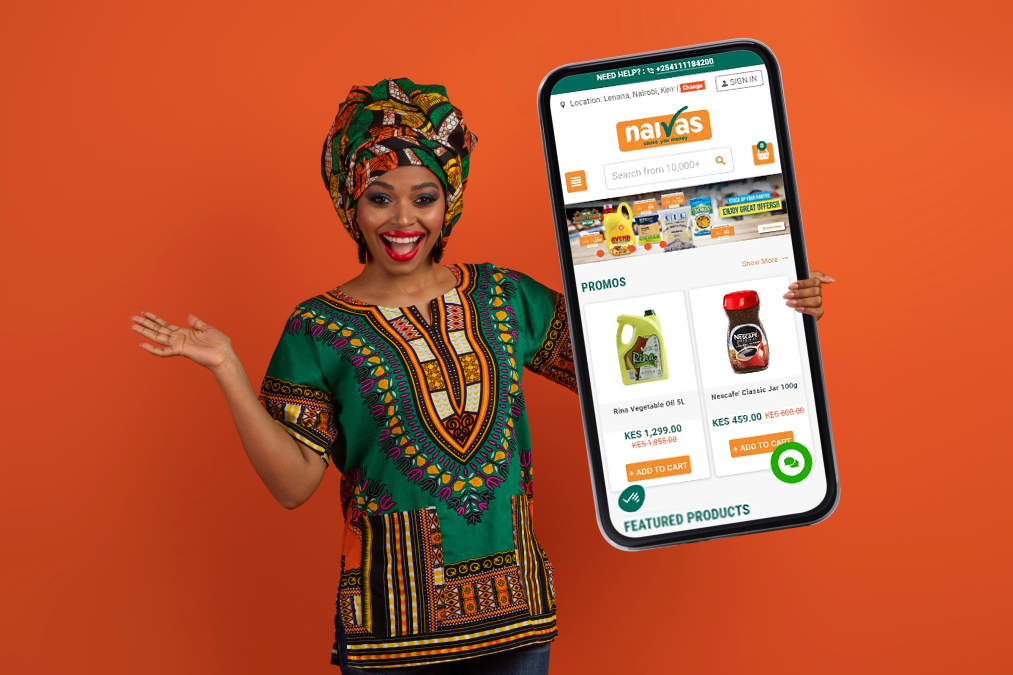

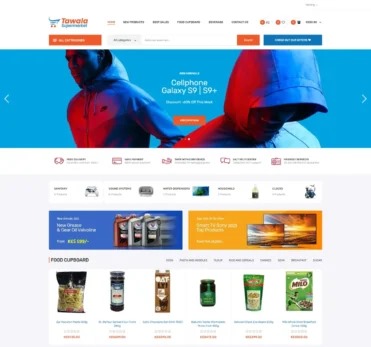

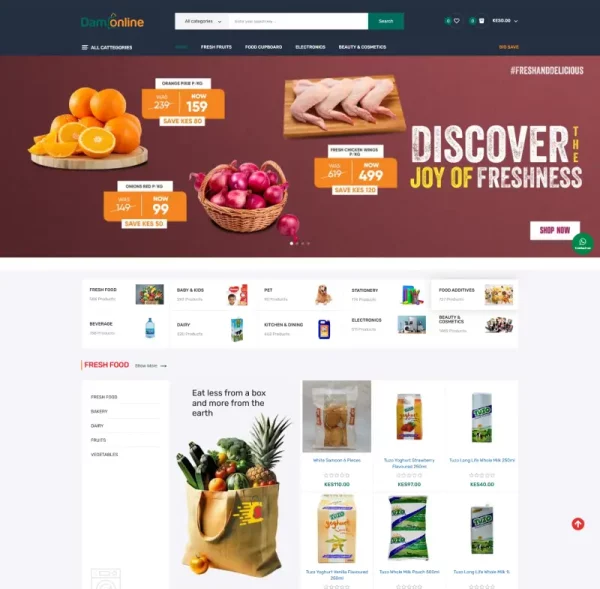

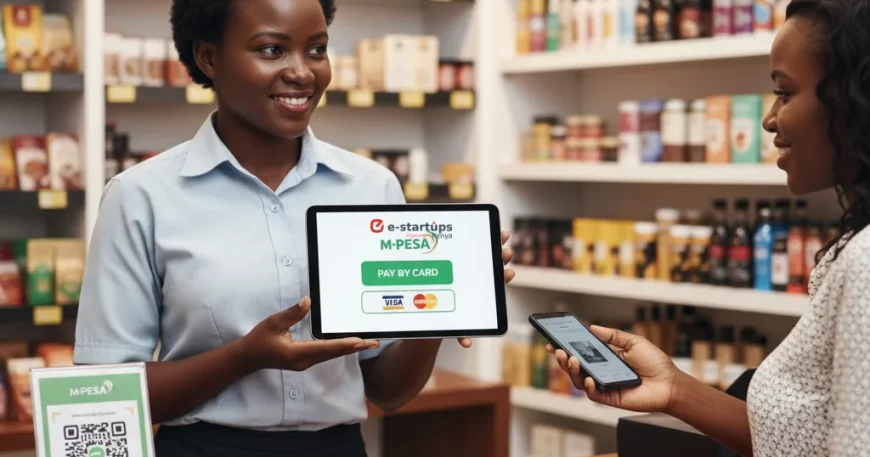

In Kenya’s dynamic retail and ecommerce sector, businesses face one universal challenge: payment chaos. Consumers expect multiple payment options, from M-Pesa to Visa and Mastercard, and delays or errors during checkout can lead to lost sales, frustrated customers, and operational headaches.

Integrating M-Pesa and card payments seamlessly is no longer optional. It’s a necessity for retailers looking to improve cash flow, increase conversion rates, and provide a professional, trustworthy shopping experience.

Why Payment Chaos Happens

Many Kenyan retailers operate with fragmented payment systems. Mobile money, card payments, and cash often run through separate platforms, creating inefficiencies. Reconciliation becomes tedious, errors creep in, and staff spend hours tracking transactions instead of focusing on customers.

For online stores, the problem is even more pronounced. If a customer attempts to pay with M-Pesa or a card and the system fails, they may abandon their purchase and never return.

The Benefits of Integrated Payment Systems

Seamless integration offers multiple advantages for Kenyan businesses:

1. Improved Customer Experience

Customers enjoy a smooth checkout process, whether paying with M-Pesa, Visa, or Mastercard. Reduced friction means fewer abandoned carts and higher satisfaction.

2. Faster Reconciliation

Sales data flows automatically into accounting systems, reducing errors and simplifying reporting. Staff no longer need to manually track transactions across multiple platforms.

3. Increased Sales

Offering multiple payment methods increases the likelihood of completing a sale. Customers appreciate flexibility, which builds trust and loyalty.

4. Better Inventory and Cash Flow Management

Real-time updates on sales and payments allow retailers to manage stock and cash flow efficiently. Businesses can restock faster, plan promotions, and maintain healthy operations.

5. Enhanced Security

Integrated systems ensure secure, encrypted transactions, protecting both retailers and customers from fraud.

Steps to Integrate M-Pesa and Card Payments

Step 1: Choose Compatible Systems

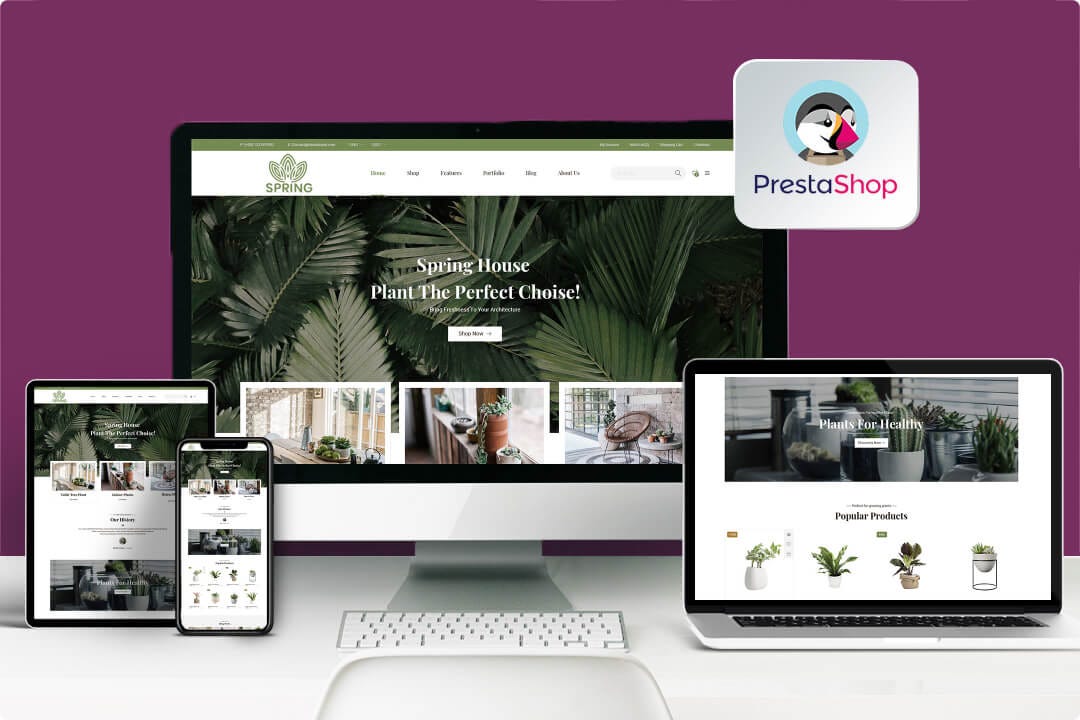

Select POS or ecommerce platforms that support both M-Pesa and card payments. Cloud-based solutions offer seamless integration, real-time updates, and scalability for growing businesses.

Step 2: Connect Payment Gateways

Set up APIs or use built-in integrations for M-Pesa Paybill, Till, and card processors like Visa, Mastercard, or Stripe. This ensures every transaction is captured accurately.

Step 3: Automate Reconciliation

Configure the system to automatically update your accounting software when payments occur. This eliminates manual tracking and reduces human errors.

Step 4: Test Transactions

Before full deployment, conduct test transactions to ensure both mobile money and card payments are processed smoothly, receipts are generated, and data syncs correctly with your backend.

Step 5: Train Staff

Educate your team on using the integrated system, troubleshooting common issues, and assisting customers during checkout. Proper training ensures smooth adoption and customer confidence.

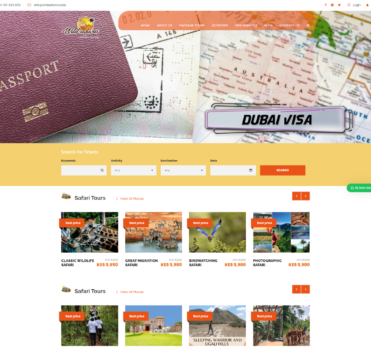

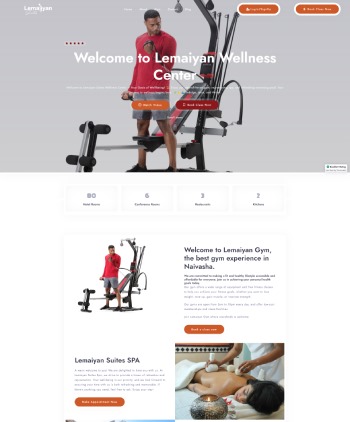

Real-World Application

A Nairobi-based fashion retailer integrated M-Pesa and card payments using E-Startups Kenya’s solutions. Previously, staff manually checked M-Pesa payments and processed card transactions separately. Integration allowed automatic updates, reducing errors and speeding up checkout. Within weeks, completed sales increased by 40 percent, and customer complaints related to payment issues dropped drastically.

How E-Startups Kenya Helps

E-Startups Kenya specializes in creating seamless payment ecosystems for Kenyan retailers. Our solutions ensure that M-Pesa and card payments work together without friction.

We provide:

• POS and ecommerce integration for M-Pesa and cards

• Real-time reconciliation with accounting software

• Secure, encrypted transactions to prevent fraud

• Support for multiple branches and online stores

• Analytics dashboards to monitor sales and payment trends

• Training and post-deployment support for staff

Our mission is to simplify retail payments so businesses can focus on growth, customer satisfaction, and operational efficiency.

FAQs

Can small retailers implement this integration?

Yes. Cloud-based solutions make it affordable and scalable for businesses of all sizes.

Is it secure to integrate M-Pesa and card payments?

Absolutely. Trusted platforms use encryption, secure APIs, and real-time monitoring to protect all transactions.

Will integration reduce errors?

Yes. Automatic reconciliation eliminates manual entry errors and saves time.

Can online stores also benefit from this integration?

Yes. Both in-store and online retailers can streamline payments and improve customer experience.

Does E-Startups Kenya provide ongoing support?

Yes. We offer continuous support, updates, and troubleshooting to ensure smooth operations.

Conclusion

Payment chaos no longer has to slow down Kenyan retailers. By integrating M-Pesa and card payments, businesses can streamline operations, improve customer experience, and increase sales.

Partnering with E-Startups Kenya ensures a seamless, secure, and scalable payment ecosystem that works for both in-store and online retail. Simplify payments, boost trust, and grow your business with smart integration.