Introduction

In today’s Kenyan business environment one thing is clear. Cash is no longer king. Customers expect fast, secure and convenient ways to pay. From mobile money to online gateways and even contactless cards digital payment solutions have reshaped how businesses across Kenya and Africa operate.

For a small shop in Kisumu, a restaurant in Nairobi, or an online fashion store targeting Africa-wide customers, digital payments are no longer optional. They are essential for growth. This article explores the digital payment solutions every business in Kenya should consider and why adopting them will give you a competitive edge.

Why Digital Payments Matter for African Businesses

Kenya is already a global pioneer in digital finance largely thanks to M Pesa which has over 30 million active users in the country. According to a 2024 report by the Central Bank of Kenya, 96 percent of Kenyan households use mobile money daily. This massive adoption shows just how central digital payments are to the economy.

Beyond Kenya, African businesses are catching up. In Nigeria, Flutterwave powers billions in online transactions. In South Africa, Yoco is helping SMEs accept card and contactless payments. For entrepreneurs and SMEs in Kenya, these solutions open up markets, improve efficiency and build trust with customers who want seamless transactions.

Mobile Money Platforms

M Pesa remains the backbone of daily transactions in Kenya. Businesses can receive payments instantly, track records through SMS or apps, and even use M Pesa Business Till numbers for transparency. Airtel Money and T Kash are also gaining traction, offering competitive rates and in some cases zero transaction fees. For SMEs, boda boda riders, small kiosks and even large corporates, mobile money ensures you never lose a customer because they lacked cash.

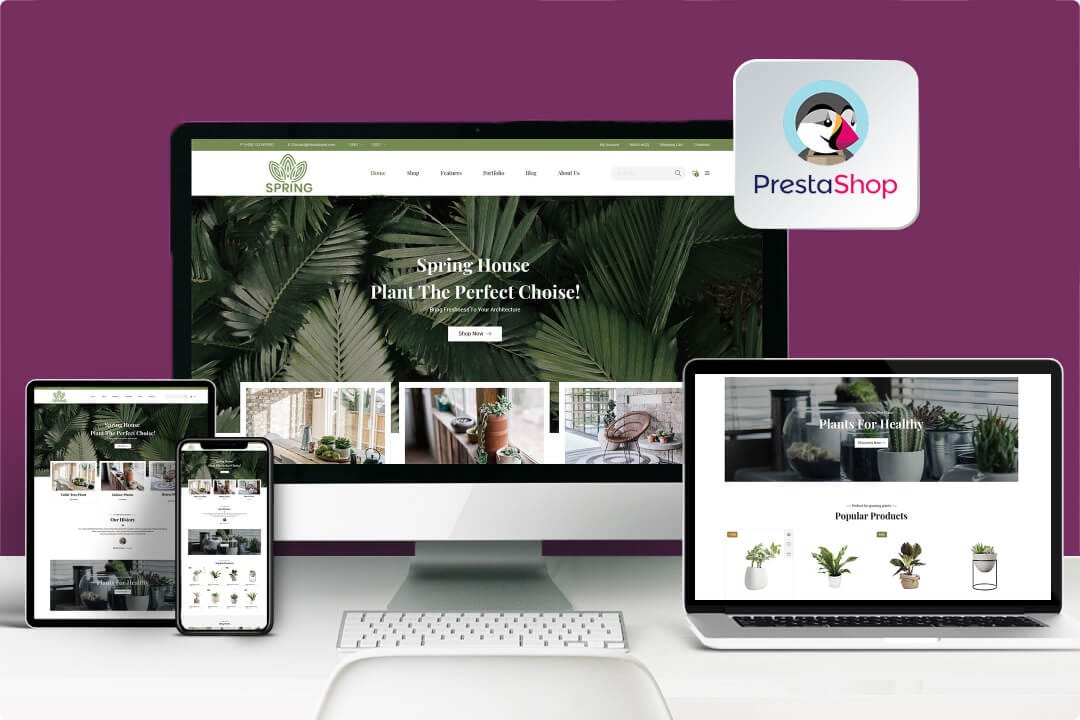

Online Payment Gateways

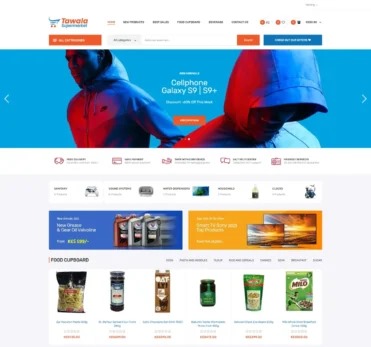

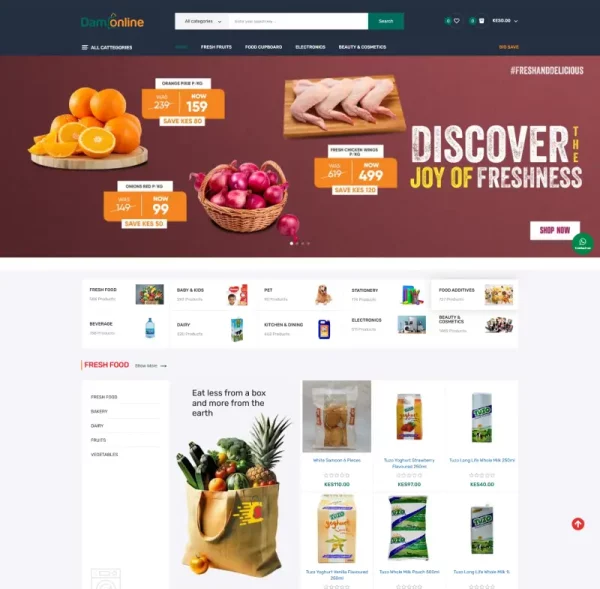

As e commerce continues to grow in Kenya, online payment gateways are becoming essential. Platforms such as Pesapal, Flutterwave, DPO Group and Paystack allow businesses to accept payments via cards, bank transfers and mobile wallets. For example, an online store built on Shopify or WooCommerce can integrate Flutterwave or Pesapal so that customers pay securely without leaving the website. This builds trust and increases conversions. Service businesses such as consultancies or SaaS platforms also benefit as gateways simplify recurring billing and subscriptions.

Bank Transfers and Internet Banking

Kenyan banks have stepped up their digital services. Equity’s Eazzy Banking app and KCB’s mobile banking platform allow real time transfers between accounts and to businesses. This is especially useful for business to business transactions where larger amounts are involved. For corporates and SMEs, integrating internet banking into accounting systems reduces manual work and speeds up financial reconciliation.

Contactless and Card Payments

Although mobile money dominates, card payments are slowly rising in Kenya. Visa and Mastercard have rolled out tap to pay cards and many supermarkets, hotels and retail outlets now accept contactless payments. For businesses in hospitality and retail, offering card payment options improves customer experience and attracts clients who prefer banking solutions. It also positions the business as modern and forward looking.

Cryptocurrency and Emerging Tech

While not yet mainstream in Kenya, cryptocurrency payments are starting to attract attention. Platforms like Binance Pay and Yellow Card are experimenting with crypto based payments for cross border trade. For Kenyan businesses targeting international clients, crypto can provide an alternative to expensive bank transfers. Although regulation is still evolving, early adoption may unlock new markets in the future.

Business Use Cases in Kenya

A Nairobi restaurant now accepts both M Pesa and Visa Tap to Pay giving customers flexible options. An online fashion store in Mombasa integrates Flutterwave to receive payments from customers across Kenya and Nigeria. A farm produce distributor in Eldoret uses M Pesa Till numbers to collect bulk payments from small retailers. A health clinic in Kisumu leverages Pesapal for secure online appointment payments.

These real world examples show that whether you are a hustler or a corporate, digital payments make business smoother.

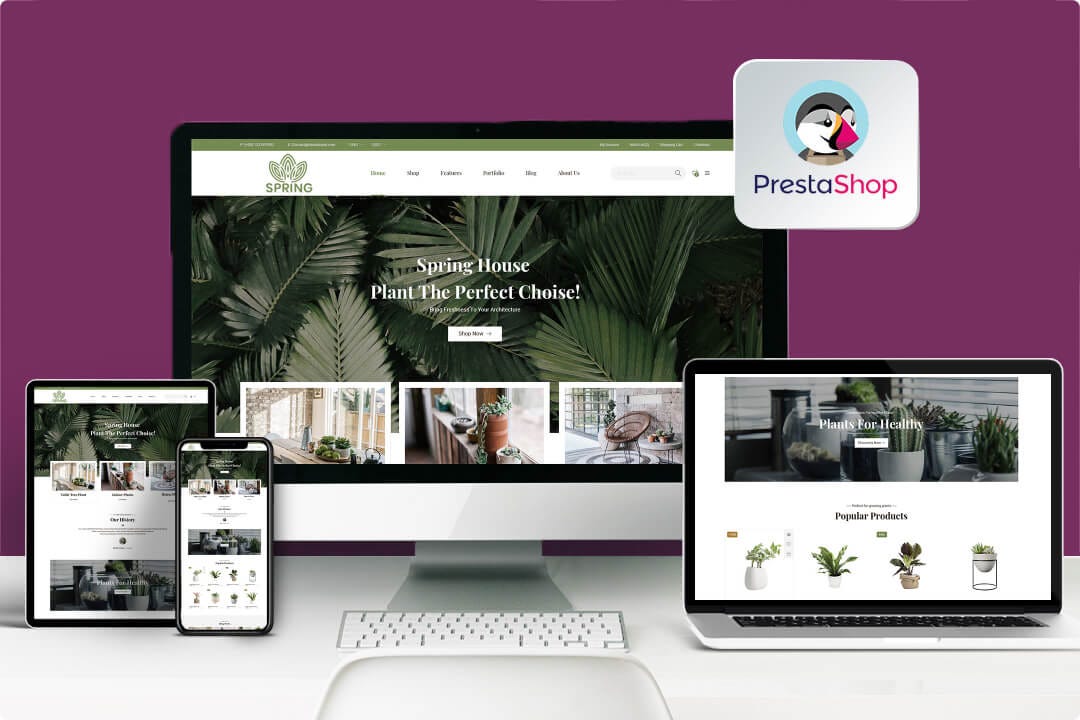

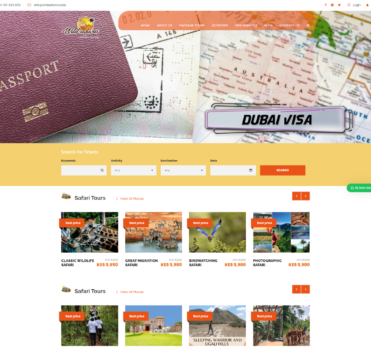

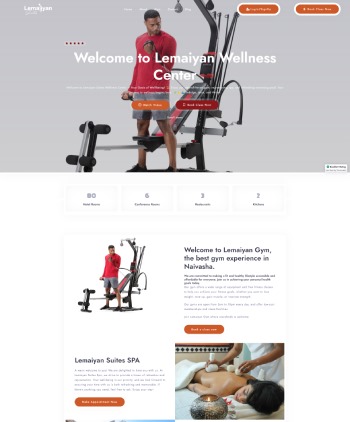

Why Partner with E Startups Kenya

At E Startups Kenya we understand that digital payment integration is more than just technology. It is about creating a seamless customer experience that drives growth.

We help businesses across Kenya and Africa with payment integrations including M Pesa, Airtel Money, cross border payments and card systems. Our team builds websites and ecommerce platforms with secure payment gateways, offers AI and automation tools such as chatbots and virtual assistants to guide customers through the payment process, and provides cybersecurity solutions to protect business and customer data during transactions. For banks, Saccos and financial startups we also design custom FinTech platforms to simplify operations.

Whether you are a startup in Nairobi or an established company looking to scale across Africa, we provide the right digital tools to keep your payments secure, fast and reliable.

FAQs

What is the most popular digital payment method in Kenya

M Pesa is the most widely used platform with millions of users making daily transactions.

Are online payment gateways safe for Kenyan businesses

Yes. Platforms such as Pesapal and Flutterwave use advanced encryption and are regulated to ensure secure transactions.

Can small businesses benefit from digital payments

Absolutely. Even small kiosks and boda boda operators now use mobile money to receive payments instantly.

How can E Startups Kenya help my business

We provide end to end digital solutions including payment integrations, ecommerce platforms and AI driven automation tailored for SMEs and corporates.

What about businesses targeting international clients

Online gateways and even emerging solutions like crypto can help Kenyan businesses receive payments from global customers affordably.

Conclusion and Call to Action

Digital payments are the future of business in Kenya and Africa. From M Pesa to online gateways and contactless cards, businesses that adapt early are already enjoying smoother operations, better customer experiences and wider market reach.

At E Startups Kenya we are committed to helping you integrate the right payment systems for your business needs. Whether you run a small hustle, a growing SME or a large enterprise, our tech solutions ensure you stay ahead of the curve.

👉 Ready to transform your business with digital payments. Contact E Startups Kenya today and let us build the future of payments together.