Introduction

Small businesses are the backbone of Kenya’s economy. From the mama mboga who keeps households fed to the young entrepreneur running an online shop, SMEs create jobs, drive innovation, and keep money circulating in local communities. Yet, despite their importance, access to credit remains one of their biggest challenges.

Banks often ask for collateral that small businesses don’t have. Loan application processes are complicated, interest rates are high, and approvals take forever. This has left many SMEs struggling with cash flow and unable to scale. But technology is changing that story.

In today’s digital economy, tech is creating new ways for small businesses to access affordable credit without the traditional barriers. Let’s break down how this is happening.

Why Access to Credit is a Struggle for Small Businesses

I. High collateral requirements

Most banks demand collateral like land titles or vehicles. For many small business owners, this is simply out of reach.

II. Long and frustrating loan processes

Getting a loan approved can take weeks or months. Small businesses often need money fast to take advantage of opportunities or cover emergencies.

III. High interest rates

Even when loans are approved, the cost of credit is often too high, eating into already tight profit margins.

IV. Lack of credit history

Many SMEs operate informally. Without proper records, they are invisible to traditional lenders who rely on bank statements and credit scores.

These hurdles explain why many small businesses end up borrowing from shylocks or relying on expensive mobile loans that trap them in debt cycles.

How Tech is Unlocking Affordable Credit

I. Digital credit scoring

Instead of relying only on traditional credit histories, fintech platforms now use alternative data such as mobile money transactions, airtime purchases, utility payments, and even customer reviews. This gives lenders a clearer picture of a business’s financial behavior and opens the door for SMEs that were previously locked out.

II. Mobile-based lending platforms

Apps linked to M-Pesa, Airtel Money, and other digital wallets are offering fast loans directly to businesses. The application is simple, approval is quick, and disbursement happens within minutes. This speed makes credit practical for small businesses that operate on tight timelines.

III. Peer-to-peer (P2P) lending

Technology is enabling platforms where individuals and investors can directly fund businesses. By cutting out traditional banks, interest rates can be lower and terms more flexible.

IV. Crowdfunding and microfinance platforms

Small businesses can now raise funds from a pool of contributors online. Platforms focused on microloans make it easier to borrow small, manageable amounts for daily operations.

V. Integration with business tools

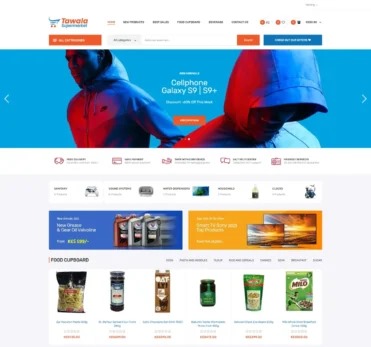

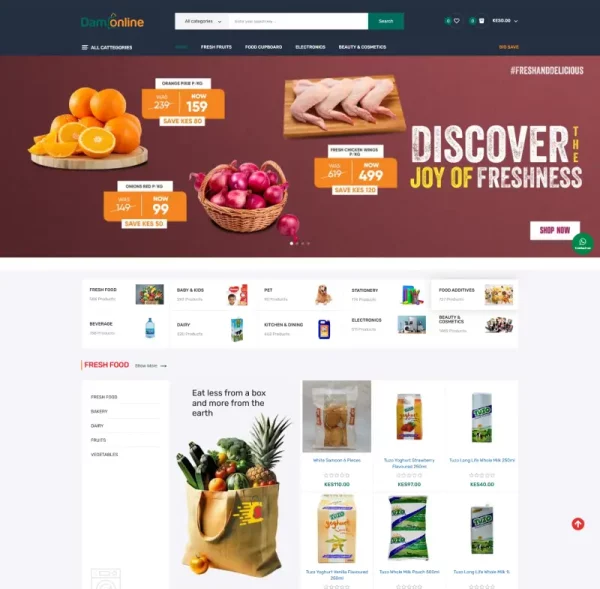

Some startups are offering credit based on the sales data businesses generate on their e-commerce platforms or point-of-sale systems. For example, a shop using a digital POS system can qualify for a loan because the lender can see consistent sales.

Benefits of Tech-Enabled Credit for SMEs

Accessibility – Businesses no longer need land or large assets as collateral.

Speed – Loans can be approved and disbursed within minutes, unlike the long processes of banks.

Affordability – With better credit scoring and competition among fintechs, interest rates are becoming more reasonable.

Flexibility – Businesses can borrow smaller amounts that match their needs instead of being forced into large loans.

Inclusivity – Even informal businesses that don’t have bank accounts can access credit if they have a digital footprint.

The Challenges That Still Remain

Even with all these innovations, there are still obstacles.

I. Risk of over-borrowing

With easy access to mobile loans, some business owners take on more credit than they can repay.

II. Fraud and scams

Not all lending platforms are legitimate. Fake apps have scammed many unsuspecting business owners.

III. Digital literacy gap

Some entrepreneurs, especially in rural areas, may not understand how to use apps or protect themselves from fraud.

IV. Regulatory concerns

There’s still a need for stronger regulation of digital lenders to protect borrowers from exploitation.

Conclusion

Technology is breaking down the walls that have kept small businesses in Kenya from accessing affordable credit. Through mobile-based platforms, digital credit scoring, peer-to-peer lending, and crowdfunding, SMEs now have more options than ever before. These solutions are faster, more inclusive, and better tailored to the realities of small businesses.

But for this transformation to reach its full potential, businesses need to borrow responsibly, regulators need to step up, and tech startups must keep innovating with the customer’s best interest in mind.

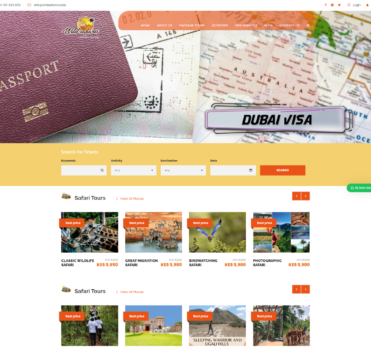

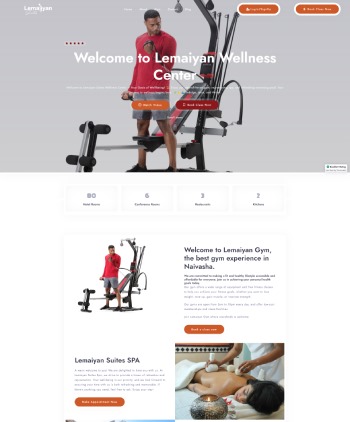

At E-Startups Kenya, we believe that access to affordable credit should not be a privilege reserved for big corporations. We provide digital solutions that empower small businesses to build trust, improve operations, and qualify for funding opportunities that can help them grow sustainably.

👉 If you are a small business owner looking to unlock affordable credit and grow, talk to us today.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.